Finding affordable car insurance is a top priority for many drivers, especially in a world where expenses seem to rise constantly. Understanding the various factors that influence car insurance quotes can help consumers make informed decisions and ultimately save money. In this article, we will delve into the nuances of cheap car insurance quotes, providing insights, tips, and strategies for securing the best rates possible.

When it comes to car insurance, several key elements play a critical role in determining how much you'll pay. Here’s a breakdown of factors that influence car insurance quotes:

- Driving History: Your history on the road significantly affects your insurance premium. Safe drivers typically qualify for lower rates, while those with accidents or traffic violations may see their premiums rise.

- Location: Where you live impacts your insurance costs. Urban areas tend to have higher rates due to increased traffic and higher chances of accidents or theft compared to rural areas.

- Vehicle Type: The make and model of your car can influence your premiums. Sporty, high-performance vehicles often cost more to insure than standard sedans, while cars with higher safety ratings can lead to lower rates.

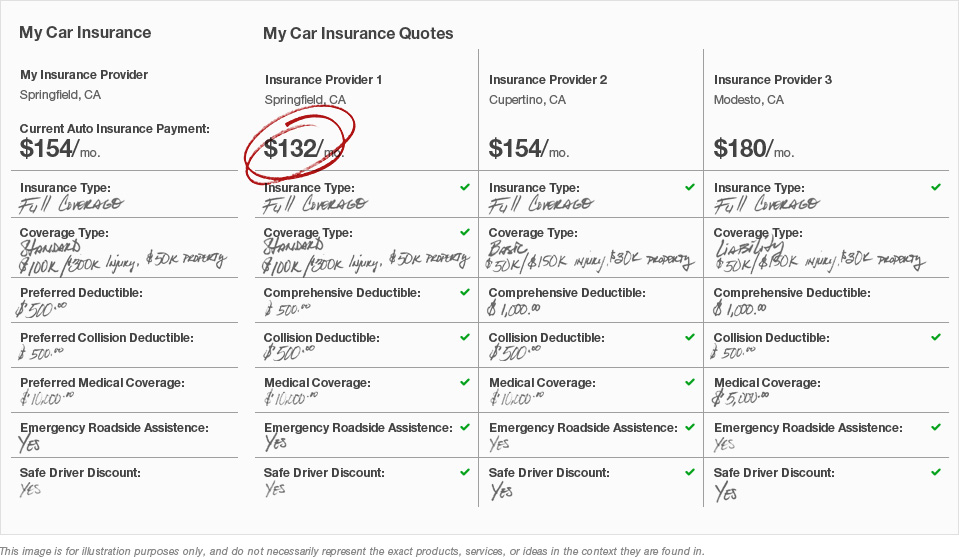

- Coverage Type: The level of coverage you choose impacts your quote. Full coverage, which includes liability, collision, and comprehensive, is pricier than a basic liability policy.

- Discounts: Many insurance providers offer various discounts that can help reduce your premiums. These may include multi-policy discounts, safe driver discounts, and discounts for good students.

- Credit Score: In many states, insurers take credit scores into account when calculating rates. Higher credit scores typically lead to lower insurance costs.

- Age and Gender: Younger, inexperienced drivers often face higher premiums due to a perceived higher risk, while older, more experienced drivers may benefit from lower rates.

To begin your search for cheap car insurance quotes, consider the following steps:

- Shop Around: Don't settle for the first quote you receive. Instead, compare rates from multiple insurers to ensure you’re getting the best deal.

- Assess Your Coverage Needs: Determine what coverage is essential for you. If you have an older vehicle, consider whether full coverage is necessary.

- Look for Discounts: Inquire about all possible discounts, including those available to your occupation, affiliations, or even your driving habits.

- Consider Bundling: If you have other insurance needs, such as home or renters insurance, consider bundling these policies for additional savings.

- Review Annually: Insurance needs can change; thus, reviewing your policy and options regularly can help ensure you’re always getting a competitive rate.

We’ll Beat Your Cheapest Car Insurance Quote! in 2020 | Cheap car

This effective marketing strategy engages potential customers by promising competitive rates and emphasizes the importance of obtaining multiple quotes for comparison.

COMPARISON | OF | CAR INSURANCE ONLINE

Online tools allow consumers to easily compare multiple insurance quotes, showcasing the best options available in their area and facilitating informed decisions.

Auto Insurance Quotes - Car Insurance Quotes Photo

Utilizing platforms that aggregate quotes can save time and effort, ultimately leading to significant savings on car insurance premiums.

Who Has the Cheapest Auto Insurance Quotes in Colorado?

Regional factors can influence insurance costs, and being aware of which insurers offer competitive rates in your state is essential for getting the best deal.

Best Affordable Car Insurance – Haibae Insurance Class

Highlighting affordable insurance options can help guide consumers towards policies that meet their financial and coverage needs.

Auto Insurance Quotes Florida Comparison Auto

Comparison shopping is particularly critical in states like Florida, where regulations and market dynamics lead to varying insurance pricing.

In understanding cheap car insurance quotes, one might ask, "What factors should I consider when searching for the best car insurance rates?"

When searching for the best car insurance rates, consider the following factors: driving history, the vehicle you drive, your local laws, coverage limits and deductibles, your demographics, available discounts, and customer service ratings of the insurers. Evaluating these factors can help identify the most fitting and affordable insurance options tailored to your needs.

Another pertinent question is, "How can my credit score affect my car insurance premiums?"

Your credit score can affect your car insurance premiums because insurers utilize credit scores as an indicator of risk. Generally, individuals with higher credit scores are perceived as lower-risk clients, which leads to lower premiums. Conversely, those with poor credit histories may face higher costs due to the increased likelihood of filing claims.

Lastly, you might wonder, "What role do state regulations play in determining car insurance rates?"

State regulations play a crucial role in determining car insurance rates by establishing minimum coverage requirements and influencing how insurers can assess risk. Each state's regulatory framework affects competition among insurers, available discounts, and overall pricing structures, leading to significant variations in premiums across different locations.